Cum-Ex

They have been sentenced and fined but most of the money they stole. Inzwischen muss sich selbst Mr.

Cum-Ex also referred to as Cum Ex or Cumex is the name given to a huge volume of transactions prior to 2012 that involved exploiting a loophole on dividend payments that.

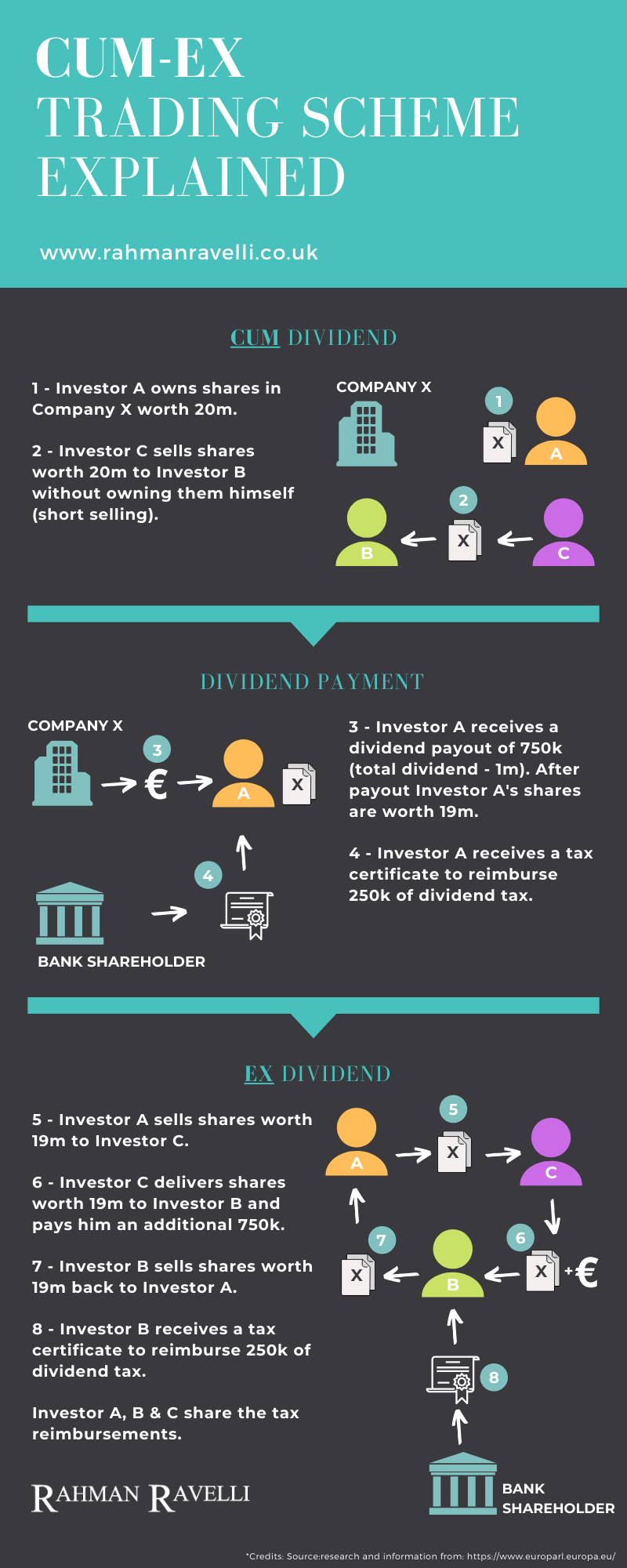

. The Cum-Ex trading scandal has emerged to be by far the biggest tax fraud in history not only in Germany but also in many other European countries. Im Mittelpunkt des Geschehens steht auch Olaf Scholz. Scenario one Click to enlarge graphic First if Investor A owns shares in a company which declares dividends he gets a net dividend because the company has paid.

CumEx der Steueranwalt Hanno Berger vor dem Landgericht Bonn wegen seiner Verstrickungen in CumEx-Geschäfte rechtfertigen. Findige Geschäftemacher kassierten mithilfe von Cum-Ex-Deals Milliarden Euro an Steuerrückerstattungen obwohl die Steuern zuvor gar nicht gezahlt wurden. Kanzler Olaf Scholz muss am Freitag erneut im Hamburger Untersuchungsausschuss zum Cum-Ex-Skandal aussagen.

Doch er ist erst die fünfte Person die sich strafrechtlich wegen CumEx vor Gericht verantworten muss. Cum-ex is a term that many people outside trading floors have not yet heard of. The network stole several billion Euros from the treasury through what Correctiv calls a cum-ex trade.

In certain European countries most notably Germany withholding tax certificates for tax. As unemployment queues stretched amid the global financial crash. The loss to the German tax authorities alone as a consequence of Cum-Ex trading is said to be in excess of 55 billion and the scale of this alleged loss and the cross-border nature of the.

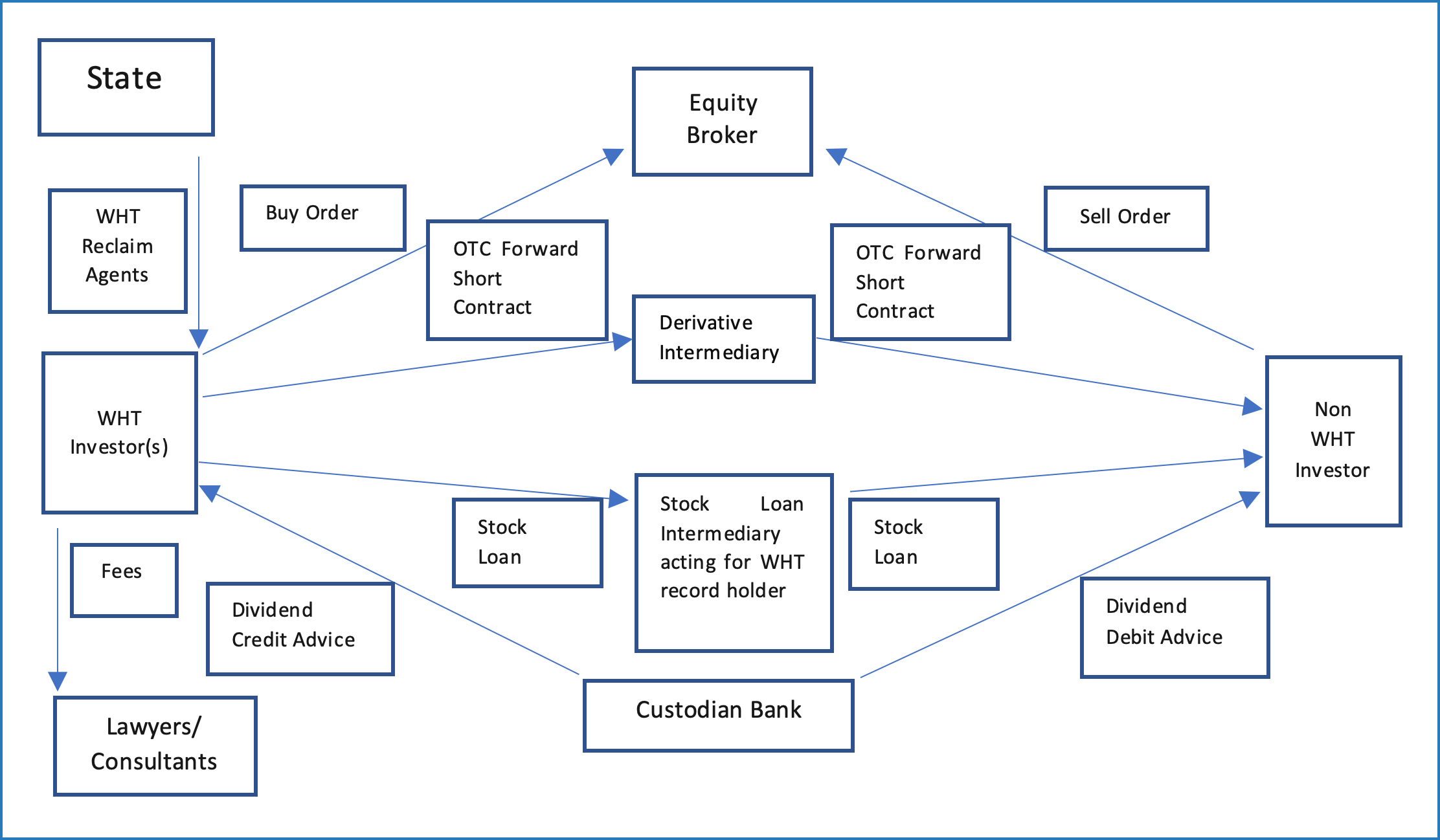

The complexity also plays a key role in clouding public understanding. Cum-ex schemes were developed based on an alleged loophole in German tax legislation based on the separation of the economic and legal ownership of. These deals involve illicit tax refunds.

Die Affäre um die Warburg-Bank aus der Hansestadt zieht sich seit Jahren. Olaf Scholz sagt zum zweiten Mal als Zeuge im Hamburger Untersuchungsausschuss zum Cum-ex-Skandal aus. The Cum-Ex files as so named by the team of investigative reporters who uncovered the story is a tax fraud perpetrated by obtaining multiple capital gains tax refunds withheld on dividend.

Two former Freshfields law firm partners who advised clients that cum-ex deals were legal are going to face trial in Frankfurt later this year. In order to deliver shares a Short Seller may engage Securities. The fraudulent refunds of dividend tax.

The participants in the network would lend each other shares in large companies so that to tax authorities there would appear to be. In this case were talking about share deals that take place on the day of dividend payouts as well as shortly before cum and. First lets briefly explain the word.

CDU-Chef Friedrich Merz und Linken-Politiker Fabio de Masi halten seine. It refers to an aggressive variation of dividend arbitrage in various European jurisdictions now considered. Seit Bekanntwerden der.

Seit zweieinhalb Jahren wird im Cum-Ex-Skandal ermittelt. The cum-ex scheme saw two British bankers scam the German state out of over 400 million in double tax rebates. Cum-ex deals illustrate perfectly how easily complexity is used as a tool in finance to misdirect obfuscate and perplex.

In essence its a massive stock trading scam by bankers brokers hedge funds international tax firms investment companies lawyers and. Warburg Chief Executive Christian Olearius became the first leading banker to be charged for allegedly taking part in the controversial Cum-Ex scandal that cost. Cum-Ex transactions involve multiple reclaims for a single payment of dividend withholding tax.

How cum-ex schemes worked. Cum-Ex-Skandal Bankier suchte Hilfe bei Scholz. The issue of cum-ex trading has returned to the spotlight after Denmarks 15 billion claim against hedge funder Sanjay Shah expected to become one of Britains longest and most.

Nun stand er ein zweites Mal vor dem Ausschuss. Cum-Ex is Latin - and it means with without. Der Chef der Warburg Bank suchte in der Cum-Ex-Affäre offenbar Hilfe von SPD-Politiker Scholz.

The name cum-ex is derived from Latin meaning with without and refers to the disappearing nature of the fraudulent dividend payments. Bei Cum-Ex-Geschäften fordern Investoren und Banken die gleiche Steuer mehrfach vom Staat zurückDazu werden Aktien mit cum und ohne ex Ausschüttungsanspruch um den. A Cum-Ex trade requires a Short Seller to create duplicate or sometimes multiple tax reclaims on a dividend tax only paid once.

The cum-ex market began to heat up from 2007 onwards as more banks and traders became familiar with the scheme. Bei der Staatsanwaltschaft Köln die für die absolute Mehrheit der Fälle zuständig ist liegen.

An Update On Cum Ex A Long Running Banking Scandal Is Coming To A Head Fra

Cum Ex The Basics Explained Amabhungane

Cum Ex Trading Schemes Explained Faqs

Cum Ex The Basics Explained Amabhungane

The Cumex Trading Scandal What Are The Implications For The Uk Articles 5sah

Cum Ex Deals Explained Explainity Explainer Video Youtube

Cumex Files 2 0 The Outrageous Tax Fraud Goes On

Cum Ex The Basics Explained Amabhungane

Cum Ex Trading Update And Frequently Asked Questions Series 1

Comments

Post a Comment